We’ve mentioned this many times before, but cash flow is critical for the health of your business. So how can we make sure that we look after our cash flow and ensure our business success?

Debtors statements are one thing that we can use to improve our cash flow. These statements are documents that we use to help us control our customers’ accounts. They are important to our cash flow and for keeping our accounts up to date because they provide an overview of all outstanding payments owed to our business by customers or clients, helping us to prepare accurate cash flow forecasts.

You can probably already see how important that information is. Using debtors statements we now know how much money we can expect to come in to our business from each individual customer or client. You might agree that this is critical data as these figures can impact the business relationships that we have with our clients. Even more importantly, debtors statements can help us produce a cash flow forecast and give us a better idea of the amount of money the business can realistically spend in the near future without jeopardising its financial wellbeing.

Sending debtors statements out to our customers at regular intervals is a good way to gently remind them that they owe us money. You probably already have the experience telling you that you’re more likely to get paid by your customers or clients when you take the time the remind them.

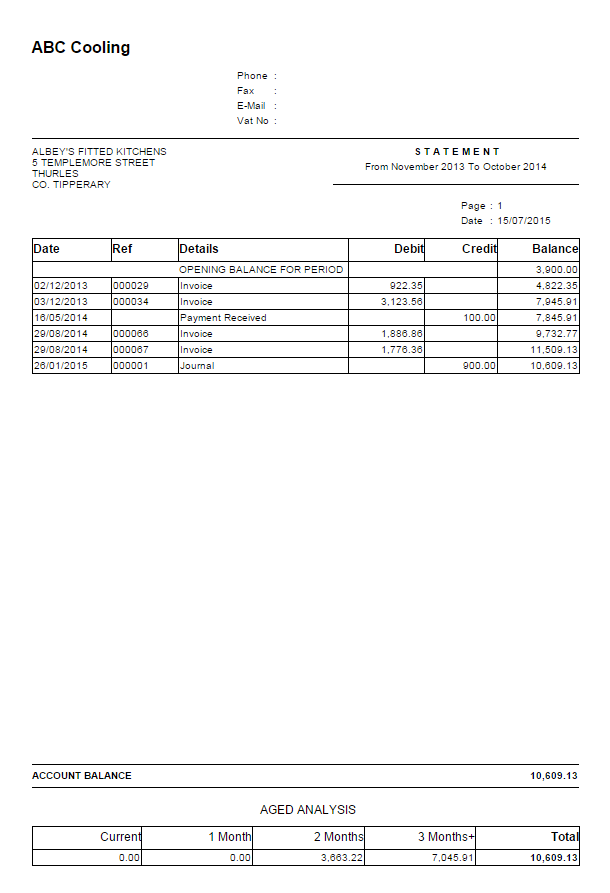

Below is a standard debtor statement that has been generated using our own Big Red Cloud accounting software. As you can see, all transactions that have been recorded in our accounts for the relevant time period are displayed. The balance column on the right shows how much that this particular customer owes us as a consequence of these transactions. We have a historical record of what invoices we have sent to our customer as well as any payments they have made to us.

Remember, when you are reading debtors statements that you produce for your customers, the amount in the debit column is the value of each sale that you have made to them while the amount in the credit column is what money they have actually paid to you as recorded in your accounts.

So, debtors statements are definitely valuable documents. By using them regularly we are actively managing our cash flow as well as the business relationships we have with our clients. If you haven’t used these statements in the past, here at Big Red Cloud we would encourage you to do so. Your accounting software package will be able to automatically generate them, and you can email them directly to your customer. Simple.