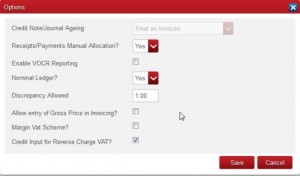

Options

Some of this information will already have been entered when the company was created.

This following warning is displayed each time Setup / Options is selected:

The reason for this warning is that Allocations affects how Opening Balances are maintained and ‘VAT on Cash Receipts’ affects the Sales VAT reported in the VAT Report and also if VAT can be entered in the Cash Receipts book.

In addition to the options given when the company was first created (see Creating a New Company) the following options are available:

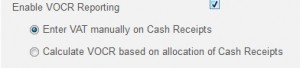

- Enable VOCR Reporting?

- Enable VAT On Cash Receipts basis reporting.

When this option is selected, you will, if allocations are on, be given the option of manually analysing VAT of Cash Receipts or basing VAT on Cash Received on allocation of Receipts.

If Allocations is Off then only the first option is available.

Allow Entry of Gross Price in Invoicing?

When this option is selected the Gross Price can be entered for a Sales Line Item and the system will calculate the unit price.

Margin VAT Scheme?

When selected this option provides a facility in Sales Book entry to ‘Calculate Margin VAT’ for transactions on which VAT is only charged on the Margin, i.e. VAT is only charged on the Sale Price less the Purchase Price.

If Allocations is Off then only the first option is available.

Allow Entry of Gross Price in Invoicing?

When this option is selected the Gross Price can be entered for a Sales Line Item and the system will calculate the unit price.

Margin VAT Scheme?

When selected this option provides a facility in Sales Book entry to ‘Calculate Margin VAT’ for transactions on which VAT is only charged on the Margin, i.e. VAT is only charged on the Sale Price less the Purchase Price.